voluntary life and ad&d worth it

Rates starting at 11 a month. Browse Several Top Life Insurance Providers At Once.

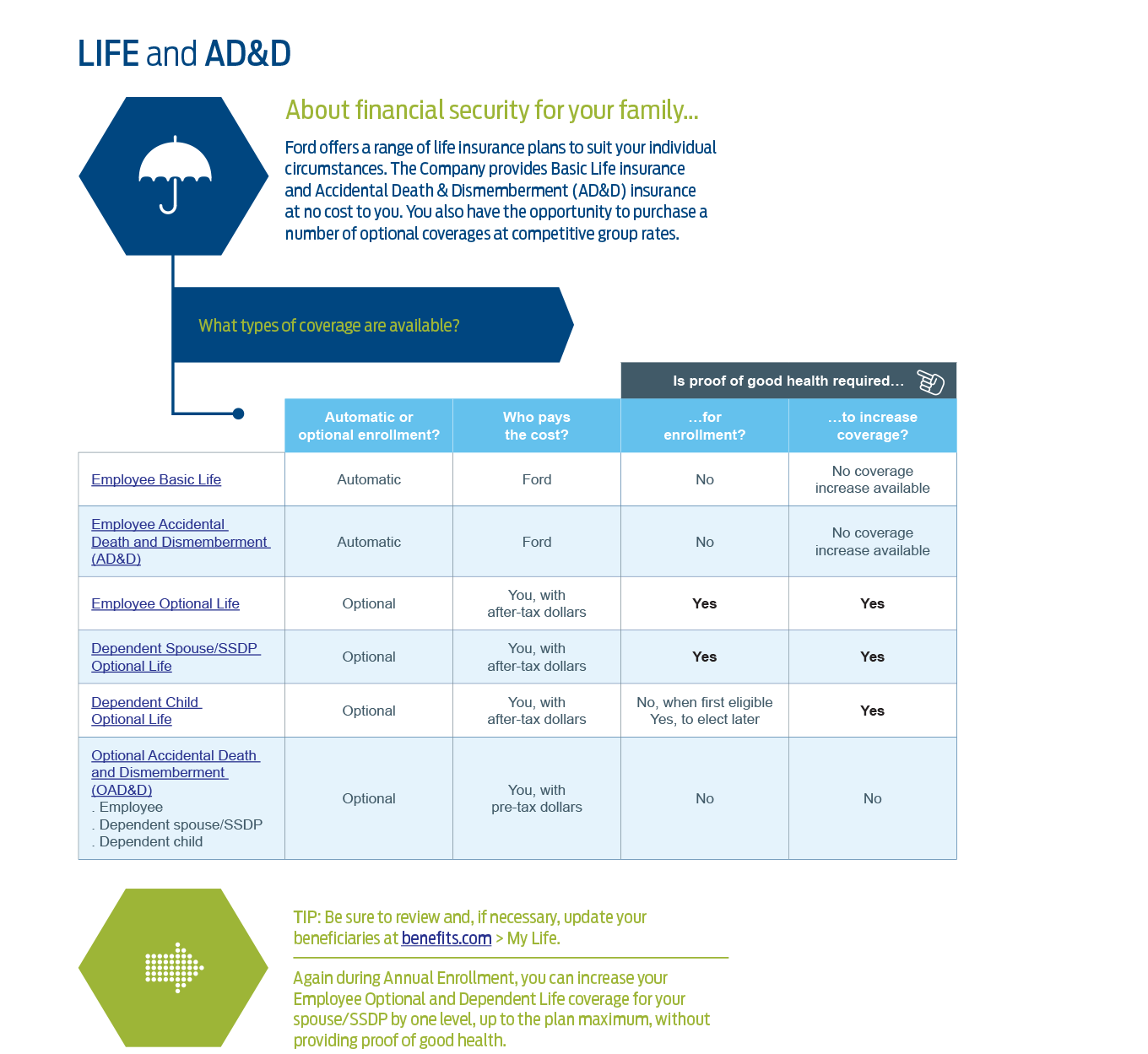

If your company plans to pay for coverage you will find the low premiums for ADD insurance a pleasant surprise.

. Apply Online and Save 70. An ADD policy may be a good idea especially if you work in a high-risk job. Accidental death and dismemberment insurance ADD for example is a benefit many companies offer but few.

See your rate and apply now. Ad The Comfort of a Reliable Life Insurance is Priceless. The employee pays the monthly premium to the insurance company.

To give you an idea of how much you. What Is Voluntary Life and ADD Insurance. Find The Right Plan For You.

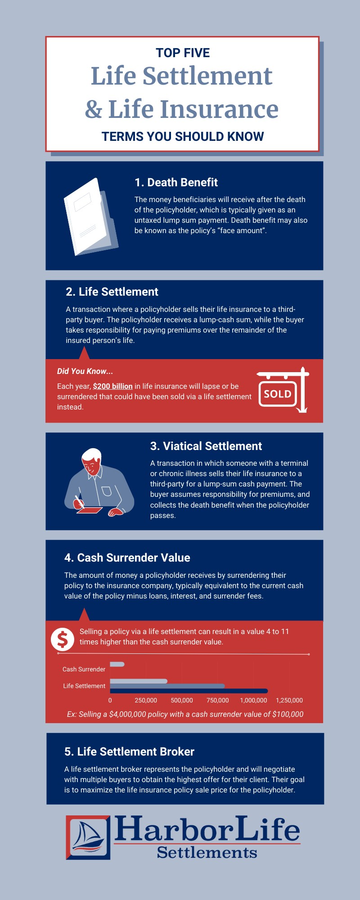

Employee benefits especially insurance can be complicated. Is Voluntary life ADD worth it. Voluntary accidental death and dismemberment ADD is a limited life insurance coverage that pays the policyholders beneficiary if the policyholder is.

With term life insurance the employee is covered for a specific term 1. Accidental death and other covered losses occur rarely. Get Instantly Matched with Your Ideal Life Insurance Plan.

I believe as long as its below 50k it is not. Up to 150000 in coverage. Rates starting at 11 a month.

For example monthly premiums might start at 450 for every 100000 in accidental death. People with riskier jobs pay higher premiums than people with low. Voluntary life insurance is an employee benefit option offered by many employers to their employees.

Ad Exclusive term life insurance from New York Life. Accidental death dismemberment ADD insurance is a type of insurance commonly added as a rider to a persons health insurance or life insurance. See your rate and apply now.

Is Voluntary life ADD worth it. Ad A Policy Will Protect Provide For Your Loved Ones When You No Longer Can. Voluntary term life insurance is the most common type of voluntary life insurance offered to employees.

Up to 150000 in coverage. Ad Exclusive term life insurance from New York Life. Voluntary life insurance is a financial protection plan that provides a beneficiary with cash in the event that the policyholder dies.

An ADD policy may be a good idea especially if you work in a high-risk job. Costs of ADD insurance. Voluntary life insurance is a financial security and protection policy that at the time of the death of the insured policyholder pays a recipient or.

Typically the group life is for included as a fringe benefit at no cost to the employee and is tax deductible by the employer. Voluntary life insurance is an optional benefit. In general ADD insurance costs are tied to the amount of coverage you purchase.

People with riskier jobs pay higher premiums than people with low. No Medical Exam - Simple Application. Ad Senior Life Insurance With No Exam Fast Coverage.

Since its scope is limited ADD insurance usually costs less than a term life insurance policy of the same length. Ad Life Insurance You Can Afford. Voluntary life insurance also known as supplemental life insurance is an optional employee benefit that increases employer-provided basic life insurance coverage.

Accidental Death And Dismemberment Insurance Policy Advice

Life Insurance Accidental Death And Dismemberment Ad D Quest Insurance The Best Value For Your Insurance Dollars

Are Voluntary Benefits Worth It

50 Must Know Life Insurance Statistics In 2022 Shortlister

Term And Permanent Voluntary Life Insurance Guardian

Benefits Voluntary Life And Ad D

Basic Life And Ad D Insurance Henderson Nv Hr Benefits

Life Insurance Vs Ad D Insurance The Insurance Bulletin

Find The Right Life Insurance Forbes Advisor

Voluntary Spouse Life Insurance What Is It 2022

Voluntary Spouse Life Insurance What Is It 2022

Voluntary Life And Ad D College Station Isd

Life And Ad D Insurance Mypetcobenefits